Published on Monday 8 April 2024, NFDA’s Dealer Attitude Survey, Winter 2024 edition, was carried out over a five-week period between the end of January and the start of March 2024, asking franchised dealers 59 questions about the ongoing business relationship with their respective manufacturer(s). The survey attracted 2,321 responses from 32 franchised networks, equating to an overall response rate of 63%.[1]

“The release of NFDA’s Dealer Attitude Survey provides a comprehensive overview which delves into the intricacies of the dealer business landscape, offering invaluable insights into the challenges, trends, and opportunities shaping the industry. The survey included questions assessing profit levels, new and used car margins, and evaluating the relationship between manufacturers and dealers” said Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA) which represents franchised car and commercial retailers across the UK, commenting on the results of the NFDA Dealer Attitude Survey (DAS) Winter 2024 edition.

Key highlights from the DAS Winter 2024 edition from a business perspective include:

- Profit Return

Dealer satisfaction regarding current profit returns have experienced a slight decrease, with an average score of 6.1, down by – 0.1 from the Summer 2023 edition (-1.6% change). Assessing the trends, from previous DAS surveys, current profit return scores have been variable with dealers having had to weather shortages in the global supply chain and a cost-of-living crisis. Kia held the top spot with a score of 8.8, a reduction of – 0.3 from their score of 9.1 in the previous survey. MINI and Lexus rounded off the top three with scores of 8.3 and 7.7 respectively. The lowest scores were received by Jaguar (2.7), DS (3.5) and Seat (3.9).

Conversely, dealer satisfaction levels for future profit returns appear more optimistic with the average increasing to 6.1, a 0.3 increase. Again, Kia held the top spot with 8.7, followed by Lexus with 8.0 and Dacia with 7.7. Jaguar (3.1), Seat (3.5) and DS (3.5) received the lowest scores although Jaguar and DS did improve on their scores received in the previous edition (1.6 and 1.3 respectively).

- New and Used Vehicle Margin

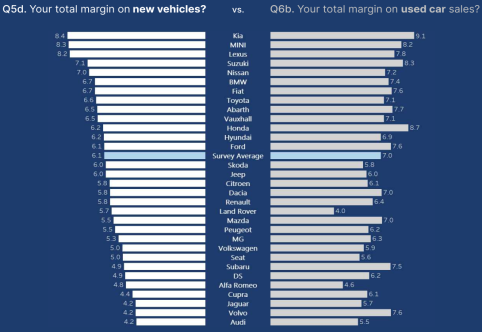

The survey indicates that used vehicle margins continue to outperform new vehicle profit but there are some clear deviations across different brands. Over time, the DAS has shown a widening gap between the profit margins of new and used vehicles, reflecting the relative strength of the used market and potentially the impact of evolving new vehicle margin models. Kia scored high on both new and used vehicles receiving scores of 8.4 and 9.1 respectively. Audi received the lowest average score, receiving 4.2 for new vehicle margins and 5.5 for used vehicle margins.

|

- Meeting manufacturer sales targets in the current market

In this edition of the DAS, a new question has been introduced, querying dealers on their ability to meet their manufacturers’ new car targets in current market conditions. This received an average score of 5.9 suggesting a lack of confidence in hitting targets in the current market against a weak economic backdrop. MINI topped the list with a score of 8.4, closely followed by Kia with 8.3 and Nissan rounded off the top three with a score of 7.4. Jaguar (3.4), DS (3.8) and Volvo (4.3) received the lowest scores.

|

- Manufacturer Relationship

Dealer satisfaction with their ability to do business with manufacturers on a day-to-day basis has increased by 0.6 to 7.1, a change of 9.2%. Stellantis Group brands saw the biggest improvement in manufacturer relationship after scoring low in previous surveys, including Citroen (+148%), DS (+146%) and Vauxhall (+132%). Conversely, Jaguar saw a decline of -32%, followed by Cupra (-19%), MG (-18%), Audi (-17%) and Volvo (-15%).

- Further Comments from Sue Robinson

Sue Robinson concluded: “The DAS Winter 2024 edition has revealed interesting insights into the current economic climate and business environment that dealers are navigating through. Significantly, it appears to reveal that current profit levels remain subdued although there is optimism from dealers in respect of profitability over the medium term.

“It is positive to see that dealer satisfaction in relationships with their respective manufacturers has mostly improved, notably with the Stellantis Group brands showing some improvement. In contrast, dealer's confidence in meeting manufacturers' sales targets reflects market uncertainty.

“Finally, the DAS is showing that the gap between new and used vehicle margins is widening, although the new vehicle market is certainly showing signs of improvement.

“Dealers have demonstrated remarkable resilience in recent years weathering challenging conditions including a cost-of-living crisis, global supply chain issues and the fallout of the Russia-Ukraine conflict.”